Are you looking for a real time stock screener on which you can run all your favorite stock scans?

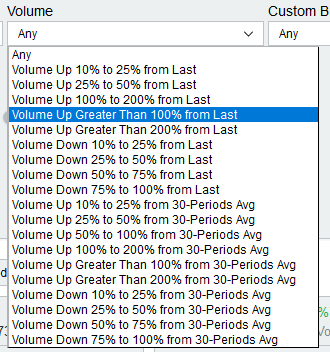

Well here’s the good news. Stock monitor has now integrated real-time data from IEX. This means you can now build unlimited custom filters and scan the whole market in real time.

Until recently StockMonitor ran on 15 minute delayed data. By integrating with IEX it means daytraders can use real-time data which is essential to detect breakouts, gaps and other types of technical analysis which rely on live prices.

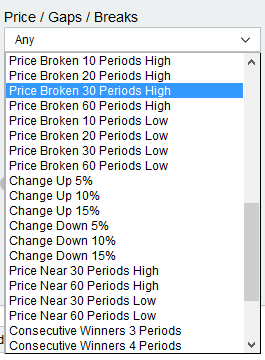

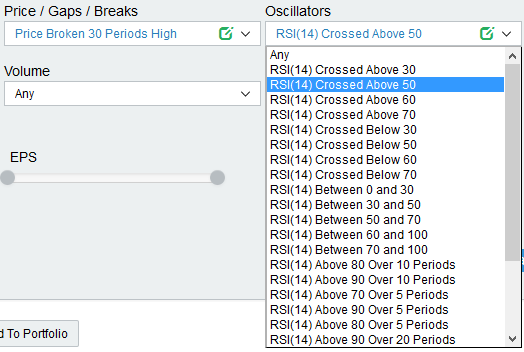

For instance if you are a trader who likes to catch breakouts of a 10 day high, now you can detect them happening within a minute of the market opening. In the past you would have to wait 15 minutes before seeing the data.

Real-Time Stock Watch List and Portfolio

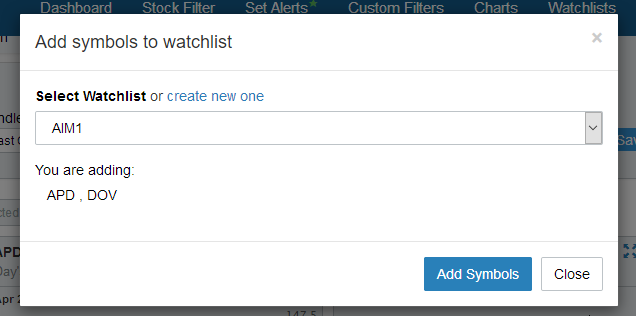

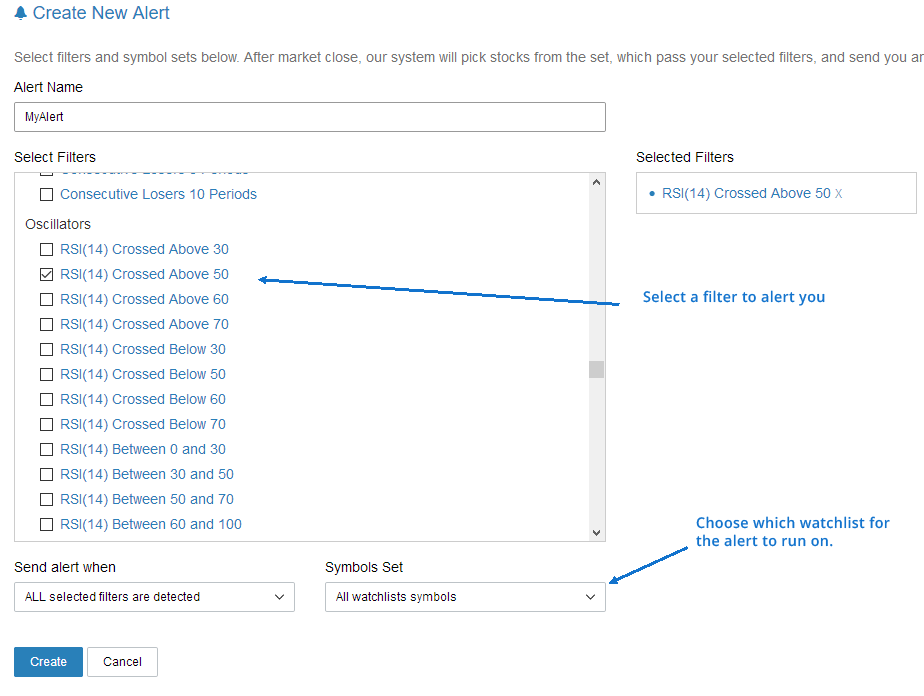

Even if you are not a day trader real-time data still has many benefits. There are many people looking for Google finance alternative. Portfolios were a really cool feature of Google finance but recently they decided to discontinue this feature. You can now create unlimited real-time watchlists for your stocks or unlimited real time stock portfolios inside stock monitor.

With our real time stock portfolio you can add buy and sell transactions and keep track of the value of your investment portfolio in real time.

The best thing is we are not going to change the price of our service, even though we have integrated this brand-new real-time data. We are committed to providing value for money service.

It is our commitment to providing value for customers which makes us feel we are the best paid stock screener available. For our low monthly price you get access to real-time data in your stock portfolios, stock charts, custom filters, stock portfolios, back tests and more.

If you want to test our real time data, then try out our totally free 14 day trial. No payment details are needed to try us out, simply enter your email and start today on real-time data.

Take from https://www.stockmonitor.com/blog/real-time-prices-now-inside-our-screener/